Some reports showed that ICOs, a way of crowdfunding in the crypto economy, has been around since 2013. However, this model of capital raising and fund development was relatively underdeveloped and unfamiliar until 2017. And that’s the year when ICOs reached their whopping popularity, pushing the cryptocurrencies into the mainstream. According to the research, ICOs raised $4.9 billion in 2017, while some startups managed to raise millions within seconds. Yes, 2017 was definitely the year when ICOs showed themselves in all their fame and glory.

However, as always, there is a dark side behind the hype and excitement. Unfortunately, the large number of these projects turned out to be operated by scammers who, after a while, vanished with their investors’ money. Some up-and-coming projects failed, while others didn’t manage to generate a profit due to mismanagement. Beyond the hype and extensive public attention, remained the sad fact that only a few projects managed to survive, overcome regulatory scrutiny and bring profit to their investors

And in this blog post, we’ll take a brief look at the top projects that survived 2017’s ICO craze.

SwissBorg

SwissBorg is a decentralized wealth management platform. Based in Lausanne, but with teams in UK and Canada, the project promotes community-centric values, where individuals and institutions can benefit from a transparent investment platform. SwissBorg started its ICO on December 7th, 2017, and within the first 12 hours, the project managed to raise over $10 million and pass a soft cap of $5 million. The tokens could be purchased at the price of $0.1 CHSB token.

Today, Swissborg is a successful platform that allows investors to take funds in their hands. The company recently launched its Wealth App Rewards Program to encourage its community to grow. Here’s how the program works:

- You can invite more than one friend

- Each time you invite a friend, both of you will be rewarded with a free ticket worth between 1€ and 100€ randomly selected and specify that on average each user will get 8€

- Your invited friend can, in turn, invite other friends

Investors who share the Wealth App with their friends will earn free Bitcoin. If they refer a friend who deposits EUR50 or more in the app, both the referrer and the referee receive a reward valued between EUR1 and EUR100 Bitcoin.

Brave

Brave is an open-source web browser that blocks ads and website trackers, enabling its users to surf the Internet more securely and privately. Former Mozilla CEO Brendan Eich founded the browser. In 2017, Brave raised $35 million from its ICO, and, believe it or not, in less than 30 seconds.

Until December 2018, Brave ran on a fork of Electron — Muon but ultimately switched to Chromium. As of 2019, Brave has been released for Windows, Linux, Mac, Android, and iOS. Around that time, the company reported approximately 3 million active users daily. Good job, Brave.

OmiseGo

OmiseGo, the B2B blockchain-based finance project based on Thailand, managed to raise an impressive $25 million in June 2017. The project that aims to disrupt the traditional banking system was based on the Ethereum blockchain eventually moved to its own blockchain. The platform offers a range of services for decentralized finance, including currency exchange and asset trading.

They were one of the first ERC20 tokens that grew their community with an airdrop campaign.

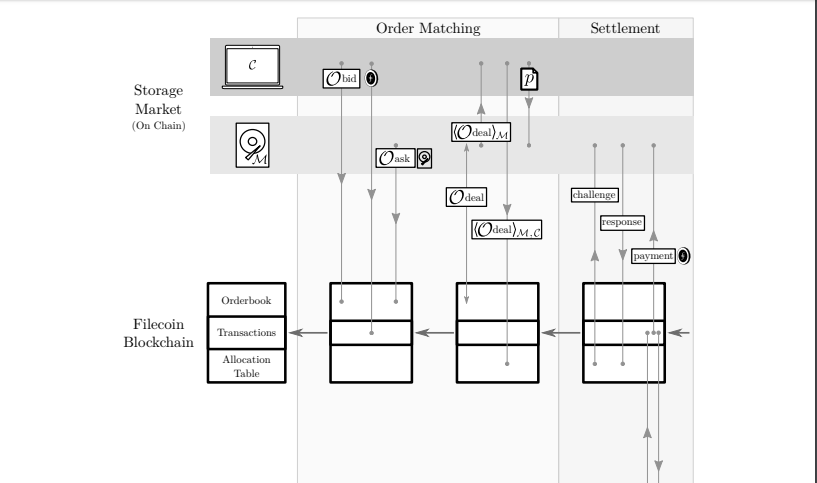

Filecoin

Filecoin is a decentralized platform for data storage, founded by tech company Protocol Labs. According to its white paper, Filecoin allows users to install special software and store data on PC’s hardware. In return, users receive Filecoin’s tokens that can be then exchanged for digital or fiat currencies. Filecoin conducted its ICO in 2017 and raised a massive $258 million. Due to the overwhelming volume and interest, the ICO has to be temporarily suspended.

Tezos

Tezos, a company based in Switzerland, developed a blockchain-based platform that enables automatic upgrades. The concept was proposed by Arthur and Kaithleen Breitman and was described in Tezos’ white paper. In July 2017, the company raised $232 million through its ICOs.

However, an internal legal battle between the Breitmans and the appointed head of the Tezos Foundation, Johann Gevers, delayed the platform’s launch and release of the tokens to investors. In December 2017, a group of private investors sued the Tezos Foundation and the Breitmans, claiming that the project’s ICO comprised an unlicensed securities offering. In September 2020, after three years, the lawsuit has concluded. Judge Seeborg approved Tezos’ $25 million settlement on Friday, ordering the distribution of funds among all persons participating in Tezos’ ICO.

Conclusion

There they are the ICOs of 2017 that managed to survive the years of regulatory scrutiny, mismanagement, and even internal conflicts. These projects proved that ICOs were more than overrated hype moved the crypto industry boundaries. Their number isn’t significant, but after all, it’s about quality, not quantity.

Keep this in mind when you’re looking to jump on the band wagon of the next Defi hype.