DeFi is a hot new topic in the crypto world. In fact, it’s so hot that in November 2020, the total value of locked in the DeFi sector had hit a whopping $13,6 billion.

Recently, AirdropAlert started a series of blog posts dedicated to earning crypto within this emerging industry. We listed some quite lucrative ways to help you out to find a way, and in this blog post, we’ll dive deep into earning crypto with yield farming. But first, let’s explain what it actually is.

What is yield farming?

Yield farming is one of the most popular, however at the same time highly risky, application of decentralized finance. It is the process of lending cryptocurrencies and, in return, generating high profit or rewards from other cryptocurrencies. In the beginning, the most popular cryptocurrencies for yield farming were stable coins such as USDT and DAI. Over time, DeFi protocols expanded to the Ethereum network and started to reward users with governance tokens for liquidity mining. These tokens can then be traded on crypto exchanges, both centralized and decentralized.

Does this description sound familiar? Maybe something like staking? Yes, the difference between the two can be a bit unclear. Let me explain.

Contrary to staking, yield farming is a more complex process. Staking usually works on the PoS consensus mechanism with a random selection process and staking rewards paid by the investors on the platform. On the other side, yield farming keeps investors’ funds in so-called lending pools, with borrowers lending funds in return for interests.

Now that we know what it is and how it differs from staking let’s take a look at the five most popular platforms where you can start earning crypto. Ready?

5 most popular platforms for yield farming

There are a variety of DeFi platforms where you can start with yield farming. Each has its own rules for incentivized lending and borrowing from liquidity pools. Each also has its own advantages and drawbacks. So, without further ado, here are the five most popular yield farming platforms:

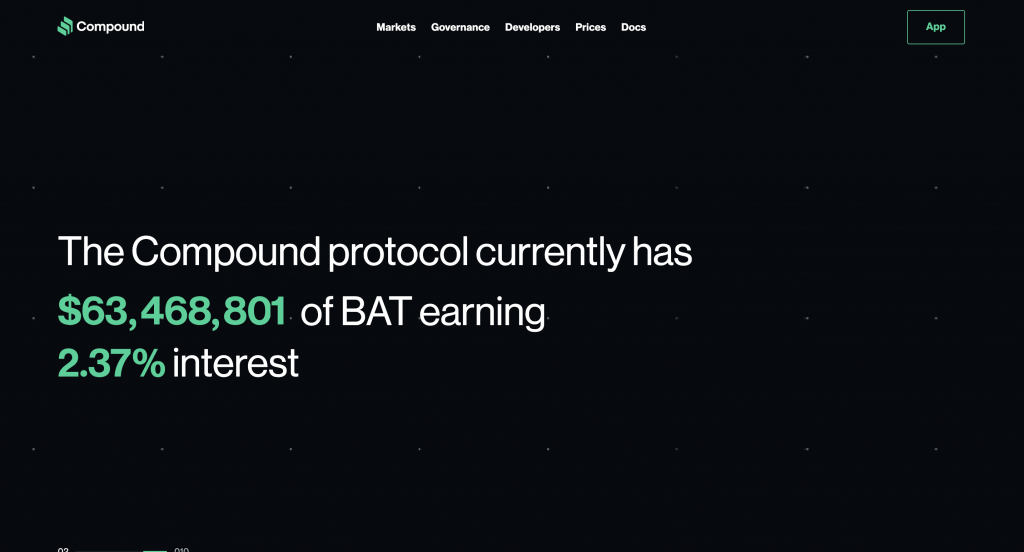

- Compound. A popular platform for lending and borrowing assets with its own governance token called COMP. Compound is an algorithmic, autonomous interest rate protocol aimed at both yield farming beginners and advanced users.

- MakerDAO is one of the most and popular and oldest DeFi projects in the crypto industry. It’s a USD-pegged stablecoin run on Ethereum blockchain, allowing users to lock crypto as collateral assets. Interest is paid in the form of a so-called stability fee.

- Aave. Formerly known as ETHLend, Aave is one of the first lending and borrowing protocols in the world of DeFi. The platform allows users to obtain loans without collateral, and, at the moment, it has a locked value of more than $1,5 billion.

- Uniswap, a popular decentralized exchange, allowing users to swap a wide range of ERC20 tokens without any middlemen. With Uniswap, users can earn a percentage of transaction fees and the UNI governance token.

- Balancer. A yield farming platform that allows providers to create customized pools with token ratios that may differ. Balancer differentiates itself from other similar platforms by charging fees to traders, who rebalance their portfolio and follow arbitrage opportunities.

Other popular yield farming platforms worth exploring are Synthetix, Yearn.finance, Curve, Harvest, Ren, and SushiSwap.

Don’t forget to stay safe

If you decide to dive deep into this lucrative sector, bear in mind that although highly lucrative, it also carries a significant risk for both borrowers and lenders. It can even lead to impermanent financial loss, especially during the periods when markets are volatile.

Besides, yield farming is susceptible to various hack attacks and frauds. This often happens due to potential vulnerabilities and bugs in smart contracts. For instance, in October 2020, Harvest.Finance lost over $20 million in a liquidity hack.

Be sure to take care of your funds and stay safe during yield farming.

***

If you enjoyed this story, please click the clap button and share it to help others find it! Feel free to leave a comment below.