The suspicion that cryptocurrency exchanges manipulate trading activities is not new. As the overall cryptocurrency market is not regulated, crypto exchanges can artificially increase trading volume to appear that the instrument is more in demand than it actually is in reality.

Fake trading volume exposed

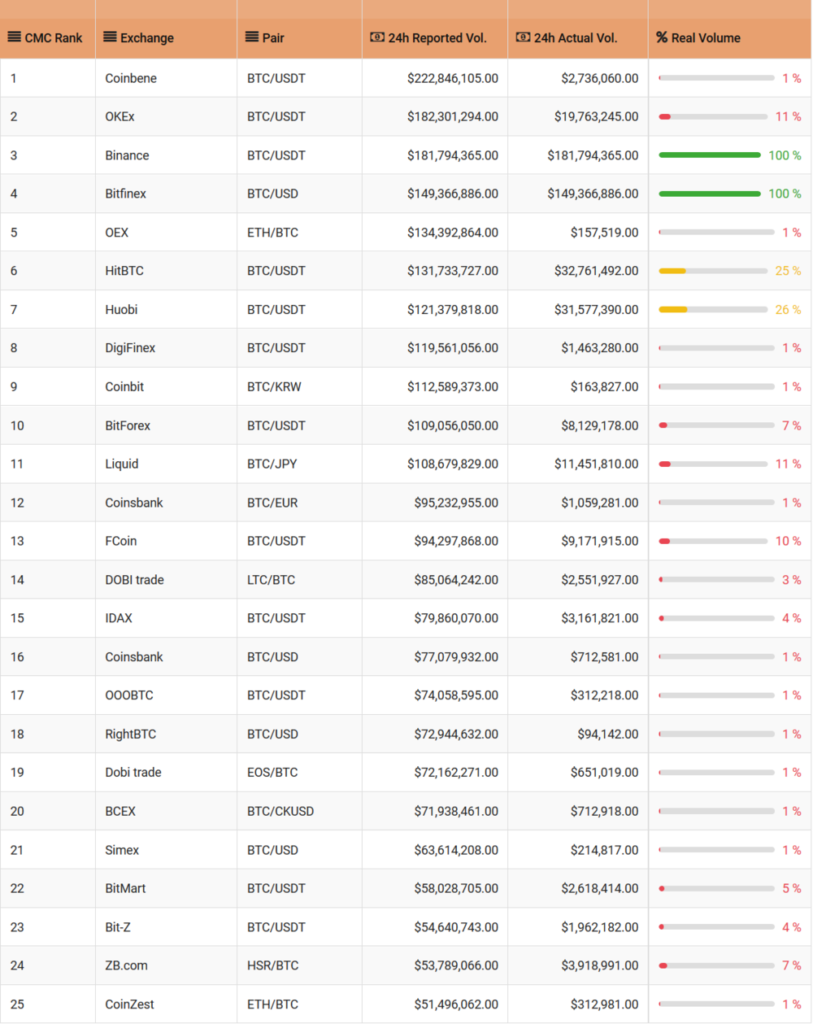

In December 2018, Blockchain Transparency Institute published a report which shows the results of analyzing the trading volume of the top 25 cryptocurrency exchanges. According to the report, the majority of exchanges are artificially increasing the daily trading volume.

Source: Blockchain Transparency Institute

And they are not the only one who did research on this topic.

Bitwise sheds light on it

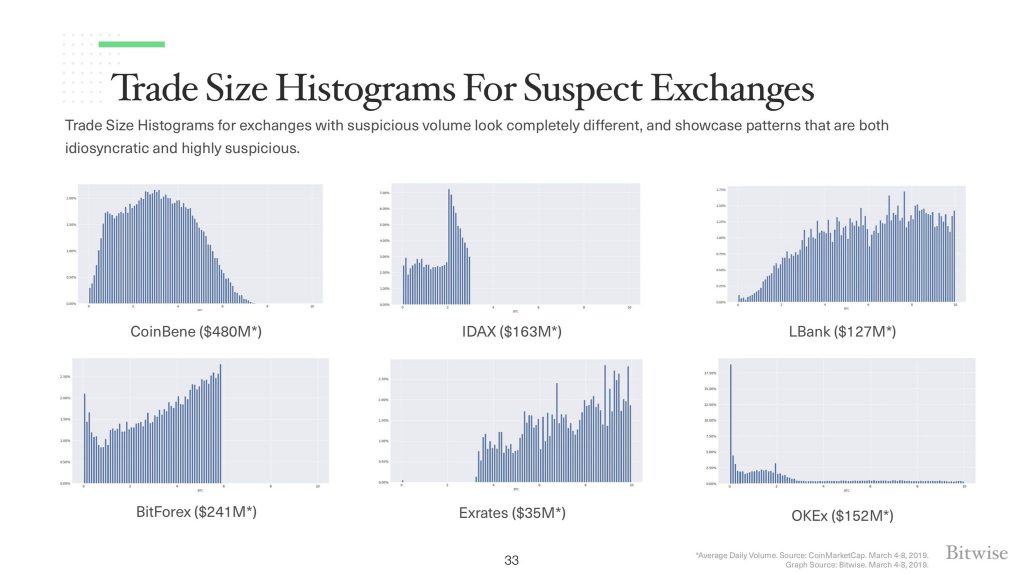

Bitwise Asset Management recently published a report which clearly shows the existence of fake volumes in the bitcoin market. According to the research, 95% of all reported bitcoin trading volume is faked or non-economic in nature.

The report, which was submitted to the SEC (U.S. Securities and Exchange Commission), includes data for 81 exchanges recording a trading volume of more than $1 million per day.

Source: Bitwise

CoinMarketCap, one of the most prominent sources of crypto trading information, claims that the bitcoin market’s average daily volume is roughly $6 billion. On the other side, Bitwise Asset Management, the provider of index and beta crypto assets funds, says that the Coin Market Cap data is wrong and that the actual average daily bitcoin trading volume is only $273 million.

Bitwise argued:

„Despite its widespread use, the CoinMarketCap.com data is wrong. It includes a large amount of fake and/or non-economic trading volume, thereby giving a fundamentally mistaken impression of the true size and nature of the bitcoin market.“

That CMC displays fake trading volume, will hurt crypto mass adoption in the long run. As exchanges like Nasdaq implement their indices as price indicators.

Among the others, the report also analyzed CHAOEX, Estonia-based cryptocurrency exchange. It turns out that CHAOEX poses an average daily volume of $70 million and indicates a monotonic chart that shows identical volume valuations every hour of the day.

As the report says:

„This volume pattern is insensitive to price movements, news, waking hours, weekends, or other real-world factors.“

Conclusion

The fact that there is a fake volume in the cryptocurrency market is not new. It’s sad but true. Wash trading and the artificial inflation of volume are a serious issue and can have significant consequences for traders. They are one more example and evidence that crypto space needs to discover a way for it to be regulated..

***

If you enjoyed this story, please click the button and share to help others find it! Feel free to leave a comment below.

Tron acquires Coinplay← P R E V I O U S

N E X T → Airbnb accepts crypto