There is a significant difference between investing in crypto and crypto trading. There are some key factors which are deciding the value of your proposition. As such, there are multiple ways of gaining crypto. You could easily earn money by participating in Airdrops, do some Trading, or Investing.

Trading, in general, can be divided between short and long-term trading. In both of these terms, there are multiple strategies which you could implement to reach your goal. If you don’t know anything about trading in general, there is a service where you can do free trading courses. www.babypips.com

Note: this is mostly a Forex (Fiat) trading course, but all necessary things will be discussed.

Comparing Trading and Investing.

“A trader is someone who wants to gain quick bucks. The investor seeks a project or multiple projects and will frame a period of where he or she will invest into”.

Just by analyzing this quote, we can conclude the following:

- A trader can be active at day or night and be called a Daytrader or Intraday Trader. Trading is something which should not be mistaken by investing. Position trading when trading positions you should follow price patterns. (more about price patterns later)

- An investor can decide to invest for the short, mid or long term. These terms vary for each particular investor. We think 3-6 months is decent for short-term investing into Crypto. 6-18 months should be considered as an midterm investment. 1.5 to 5+ years we look at as a long-term investment.

- In market trends, we have two overall factors which are thriving and perceiving a market. As example, particular market trends which are going up and down we call Bull and Bear. The difference is quite satisfying. If you spot the trend you can determine the trend line. A continuous uptrend will be called a Bull; the bulls are running. (market going up) At the other hand, a continuous downtrend will be called a Bear; the bears are hungry. (market going down).

We will discuss the following subjects

This part is vital to the part which investors decide to invest or not to invest into crypto. When digging deeper into a coin a general rule of fundamental analysis applies for both short and long-term investors or traders. You could map out this rule by the general assumption of the momentum. In general trading and investing the reason you want to buy or sell a crypto coin is decided by the momentum. That exact moment you decide to invest or buy a trade could be manipulated. Please, always do your research. Never trust a statement from out of only one source. If your interest lays into gaining crypto through trading you should check out SignalAlert

Technical analysis.

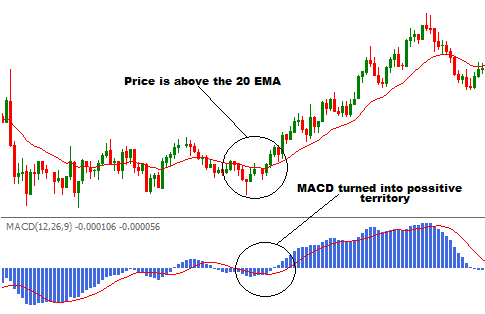

In crypto and traditional trading entities, there are multiple indicators such as the MACD. The MACD is the moving average put in a graph. See example:

MACD is the bottom graph where you can spot a market reversal.

There are numerous studies which exist altogether.

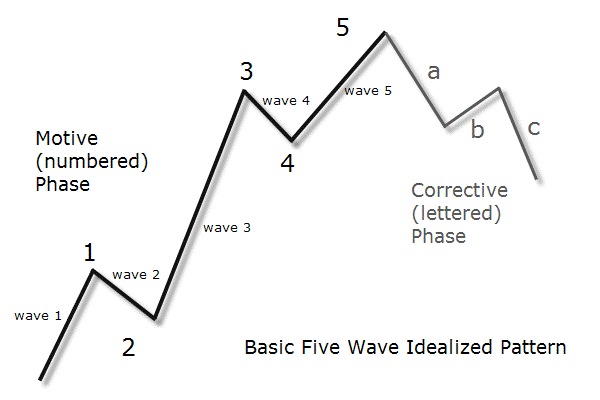

One of the most famous studies are Elliot Waves. These waves are produced on predominant psychology of traders at the exact time.

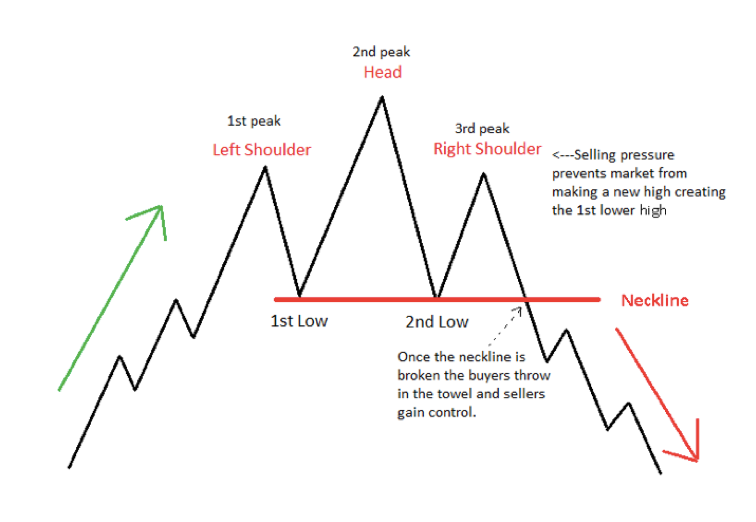

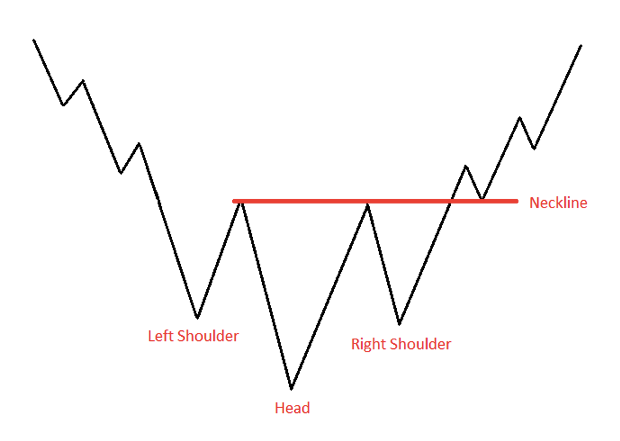

Price patterns are one of the biggest visual indicators of deciding a strategy. For such, we have one of the most famous patterns which are the Head and Shoulders and the Inverted Head and Shoulders. These patterns are indicating a few optional price movements.

When looking at the head and shoulder pattern, you can conclude that there are at least three peeks. When discovering an H&S pattern, it should indicate a break in the trend. For example, after a long bull breakout, the necks are formed it should be an indicator to close your positions. For instance, after a bear breakout, the necks are formed it should be an indicator to go short or close open positions.

When looking at the inverted head and shoulder pattern you can conclude that there are at least three peaks downward. When discovering an inverted H&S pattern, it should indicate an inconsistency in the trend. For example, after a bear breakout, the necks are formed it should be an indicator to go long or open new positions.

When concluding signals ,SignalAlert focuses only on what matters, stay in the know, spot market trends as they happen and push your portfolio further. Signals are meant to be calculations which are put directly to the test, through calculations defined by technical analysis. For market updates, technical analysis and fundamental incentives of cryptocoins join the SignalAlert Telegram.