5 Questions to Ask Before Investing in an IEO

5 Questions to Ask Before Investing in an IEO In July 2013, Mastercoin held the very first initial coin offering (ICO). Since that, countless blockchain projects have fundraised money through ICOs. But with this success, came the rapid growth of ICO scams and Ponzi schemes.

Rise of ICO scams caused the appearance of other means of cryptocurrency fundraising, such as security token offerings (STOs), initial public offerings (IPOs) and initial exchange offerings (IEOs).

What is an IEO?

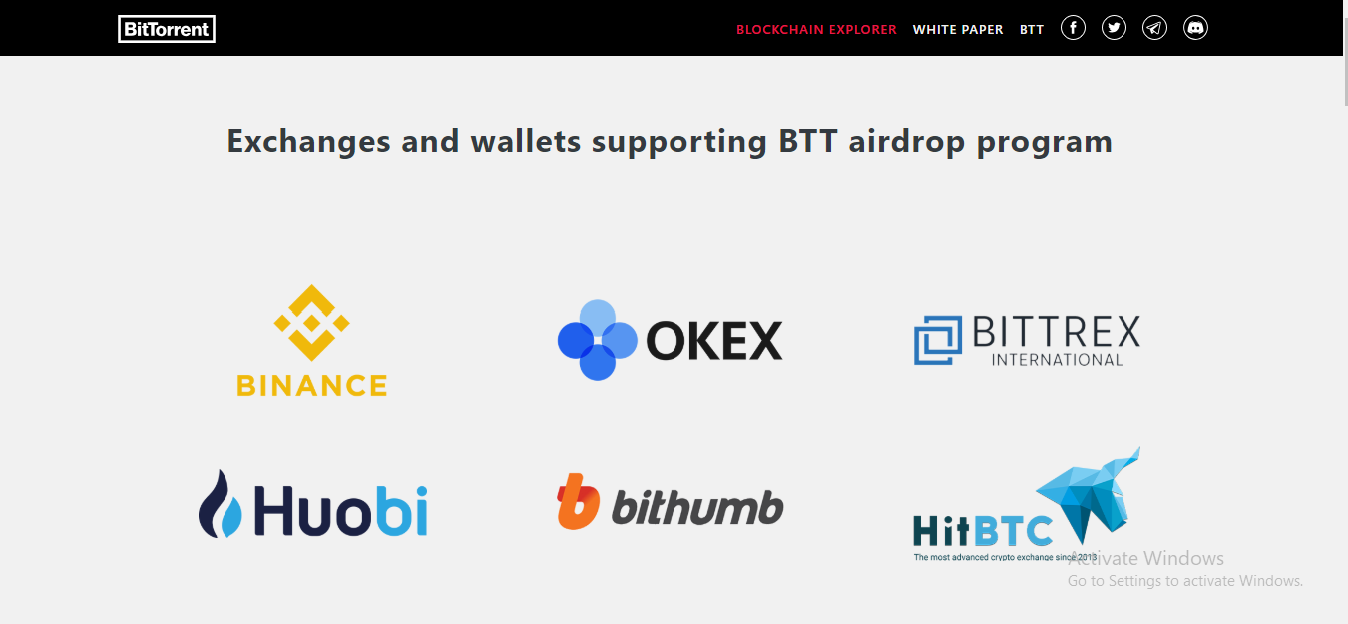

Basically, IEO is a way of fundraising with a cryptocurrency exchange as a counterparty that helps facilitate the fundraising process. Today, many crypto exchanges are supporting IEOS. For instance, Binance, the largest cryptocurrency exchange by daily trading volume, started its own IEO platform in December 2017. Some exchanges are even supporting airdrop programs.

Recently, BitTorrent (BTT), with an airdrop untill 2025, was listed on the exchange. Binance supported the BitTorrent (BTT) Airdrop Program, and in February of this year, they completed the distribution of the initial BTT airdrop as part of the overall BTT airdrop program.

Investing in IEO’s, where do you start?

Although this way of fundraising sounds tempting and more secure than an ICO, there are still some questions you should ask yourself before putting your money in an IEO.

Have you done in-depth research about the project?

Before investing in any project, not just an IEO, you should do the research. Discover what is the company’s business model, who is the team behind it, read through their white paper, and how they’re handling marketing.

Which exchanges will participate in an IEO?

Before participating, you must check wich exchanges will participate in an IEO. A token issuer might have an agreement with only one exchange, which means that you have to create an account on that particular platform (in case you don’t already have one).

Do you understand the KYC requirements of exchange?

After registering on an exchange, you must go through a verification procedure. Make sure that you’re familiar enough with all the rules of the platform, and don’t postpone it to the last day, since it may take several days to complete.

What are the available crypto payment options?

The two most common payment options are Bitcoin and Ethereum, but remember that some exchanges such as Binance go with their own tokens.

Are you from a restricted country?

Anyone can invest in an IEO if they are not from a restricted country. This means that in most cases, citizens from the United States, North Korea, Venezuela, New Zealand, China, and some other countries are prohibited from participating. Countries like these have restrictions regarding digital assets.

Final Words

We all know that ICOs created a fundraising boom in 2017/2018. But we also know this way of fundraising has a lot of flaws. On the other side, it seems that IEOs have the potential of becoming more secure and reliable model for raising funds in the crypto space and maybe even creating the next fundraising boom. Or even better, a new airdrop rise!

***

If you enjoyed this story, please click the button and share to help others find it! Feel free to leave a comment below.

Fake trading volume exposed← P R E V I O U S

N E X T → Airbnb accepts crypto